Christian Financial Advisors

You want to steward your money well, so you save, invest, and plan ahead. But did you know that millions of dollars invested by Christians every year simultaneously supports unbiblical business practices? That’s why we offer Biblically Responsible Investment options for organizations and individuals who want their investments and retirement funds to align with their Christian Values. Retirement and investing is complicated and time consuming, which is why you need a guide you can trust. We’ve been helping churches, ministries, and other faith-driven people make sense of it all for nearly three decades. Our mission is to equip believers to leverage their financial resources for the Kingdom of God. So, now you can invest and plan stress-free, knowing you have a guide who shares your vision and values for your money and future.

Independent:

Envoy Advisory, Inc. is a Registered Investment Advisor.

Universe:

Open architecture allow access to over 25,000 investment products.

Monitored:

Transparent & systematic quarterly review of the investment menu are provided.

Innovative:

There is continual focus on providing new opportunities.

What Financial Services Does Envoy Offer?

Envoy offers affordable plans (401k, 403b, IRAs, etc.), simple administration, easy enrollment, and empowering education. To make that happen smoothly, we offer advisory services, third party administration (), and recordkeeping ().

Additionally, whether you or your employees want to invest in our carefully screened and managed BRI funds, or a specific stock, you’re able to do what you would like, with Envoy’s open architecture.

Lastly, we are financial fiduciaries, meaning that we can only ever put the interests of our clients ahead of our own. Since our duty is to preserve your trust and good faith, we must legally and ethically do what’s best for you.

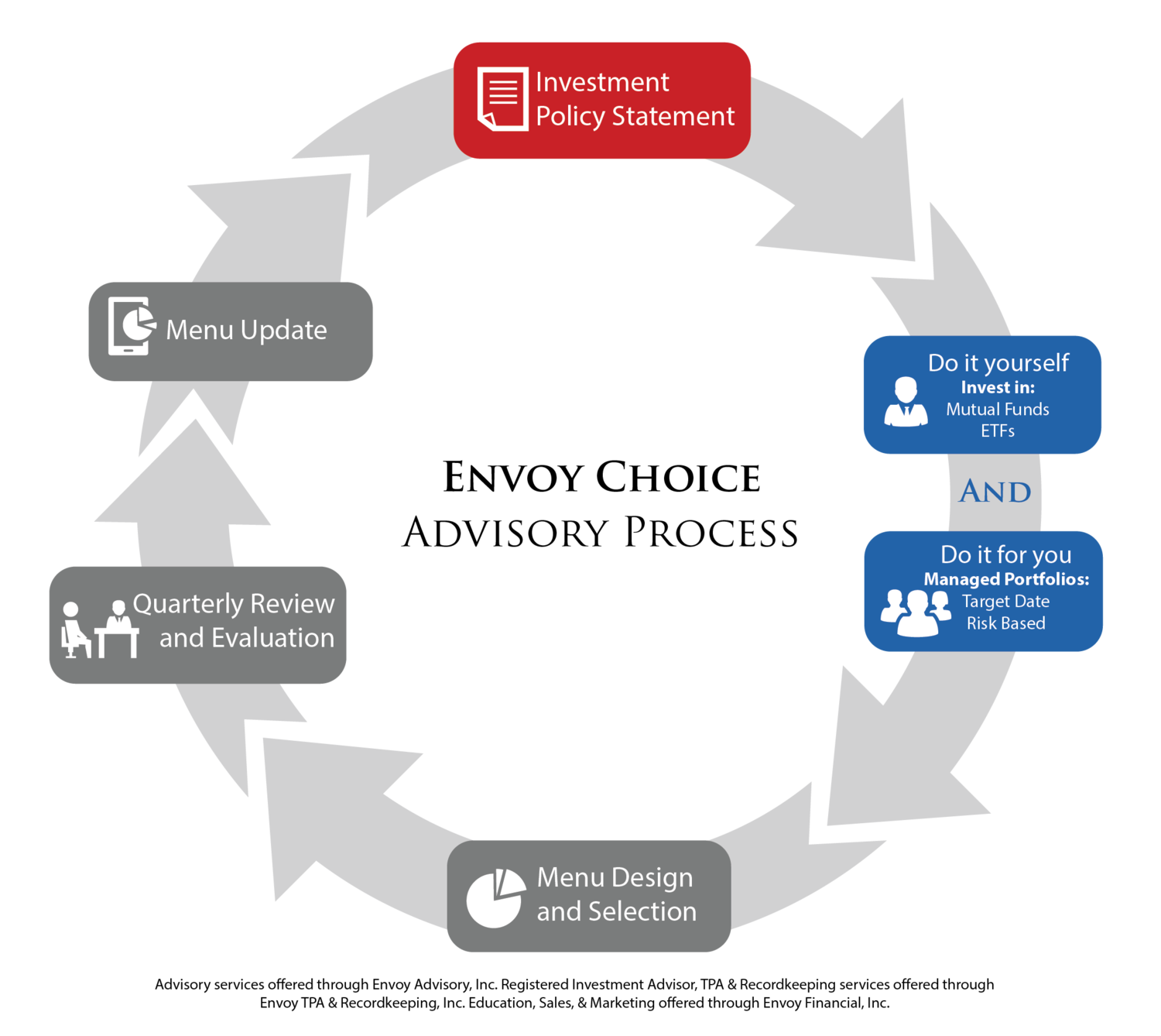

What is a Retirement Menu and Why Does it Matter?

A menu–in this case–is the set of investment options from which you can choose. Given our Fiduciary role, it’s a list recommendations Envoy has prepared for you. We provide investment options on our menu that reflect our investment policy statement, resulting in three key directives:

1. An emphasis on investments that match our Christian values (this is reflected in our BRI models curated by Harvest)

2. The ongoing commitment to reduced costs (reflected by our inclusion of various ETFs and publicly traded stocks)

3. Improve menu performance (embodied by the actively managed and monitored models created by Harvest)

Your Participants’ Investment Options

Your Church and Ministry Organization’s investment menu will be developed so EVERYONE can invest well. Whether your employees are novice or knowledgeable investors, there is an investment approach that will fit their needs. They can choose from a list of carefully screened and monitored Mutual Funds or ETFs if they feel comfortable picking from these individual investments. For those who would like additional help with their investments, they can choose from different types of managed models.

Faith-based Models

Investment models may vary widely, depending on the goal. If the hope is to reach a certain level of funds by specific year (like a retirement plan), the strategy may be more conservative than if the hope was to aggressively grow an initial amount contributed. Additionally, some plans may emphasize being Biblically Responsible, whereas others may not.

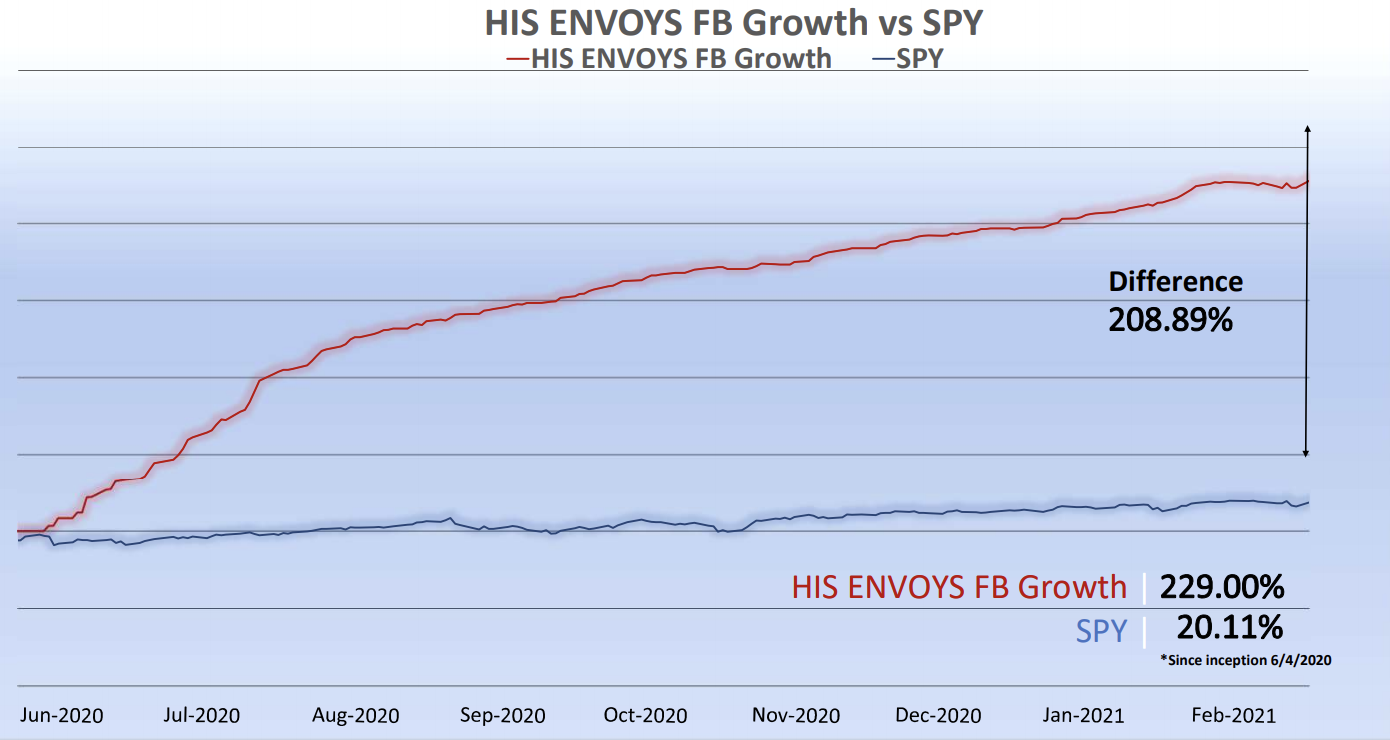

We don’t believe that aligning values with investments should result in poorly performing funds, so our partners at Harvest actively manage our BRI models to strive for a return equal to or greater than the industry average.

Exchange Traded Funds (ETFs)

Our commitment to serving our clients by continually looking for solid performing, low-cost investment options is evidenced by our ETF (Exchange Traded Fund) Basic Investment Menu. We were among the first in the faith-based community to offer ETFs, and we believe that they present an excellent vehicle for long-term index investing. Of course, clients may choose to use traditional Mutual Funds instead.

Target-Date Models

The target-date model is a managed model where the investment choice is determined by your age and when you expect to retire. With your current age being your starting point this model will become progressively more conservative as you approach retirement age. You have the option to choose either regular Target-Date Models or Faith-Based Models. The holdings within the Faith-Based Investments strictly avoid businesses involved in abortion and pornography and generally screens for businesses involved in gambling, alcohol, tobacco and war products.

Risk-Based Models

Risk-based investment models are a very popular choice by Participants. The risk-based models include Conservative, Moderate Conservative, Moderate, Moderate Aggressive and Aggressive. These models use actively managed portfolios by some of the best-known providers such as J.P. Morgan, Schwab, and TIAA. Because of an open architecture capability, these choices are regularly evaluated and replaced if not performing according to the Investment Policy Statement criteria.